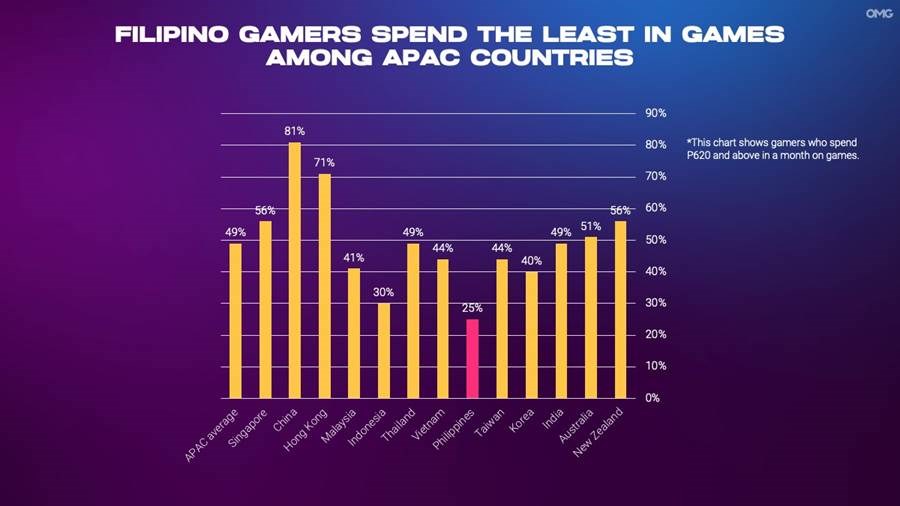

Research: Filipino gamers spend the least on games across APAC

Omnicom Media Group Asia Pacific’s (OMG APAC) latest research titled ‘Unlocking Gamers in Asia Pacific’ reveals Filipino gamers have the lowest propensity to spend P620 and above in a month on in-game purchases compared to their APAC counterparts. Gamers in China, for example, spend at least three times more, and those in Hong Kong spend two times more.

In general, 50% bought an in-game skin, character, or accessory in the last three months. Other items purchased during the period included battle/season pass (38%), gears/weapons (33%), extra lives, hints, or boosters (29%), and gaming currency (28%).

While these items offer brands a variety of opportunities to create in-game collaborations, companies might see lower-than-expected conversions due to a low average monthly spend. Also, these branded collaborations might only work if there is high brand affinity and if they offer value to gamers.

The concept of creating value for Filipino gamers is crucial because when they do spend on microtransactions, the reasons are value-specific, e.g. when there is a sale (50%), in-game power-ups (36%), gifts (31%), a treat for oneself or someone else (31%), and limited-time release (29%).

Therefore, branded microtransactions require a variety of exciting, urgent, and emotional messages to persuade gamers to purchase.

According to Newzoo, the global gaming market is expected to generate $189.3 billion in 2024. Asia offers the gaming industry a huge opportunity as it is home to 1.5 million gamers, according to Google, with a $70 billion gaming market. The industry is not losing steam in Southeast Asia either as it is now worth $6.9 billion and backed by 270 million gamers.

The research aims to offer a better understanding of Filipino gamers and covers four areas: gaming behaviors, gaming preferences, online engagement, and advertising and brand attitudes.

Mary Buenaventura, OMG Philippines CEO, said, “While Filipino gamers might experience Internet challenges such as penetration and speed, one should never underestimate the opportunities in gaming. This research indicates that most gamers can no longer be stereotyped as hermits in their dark rooms. Instead, they are highly mobile and are playing during breaks or during their daily commute, thereby democratizing the gaming experience. To succeed in this space, brands are encouraged to invest in game development or in-store gaming experiences that meet the high expectations of Filipino gamers’ and offer them original, real-world moments.”

For brands eager to target Filipino gamers, here are some key consumer needs and behaviors to take note of:

Provide originality in games; create real-world moments around games

Filipino gamers want gaming collaborations to be a seamless merger between the game and the real world. To fulfill their desire to be incentivized and capture Filipinos’ attention, brands can create original games, in-store gaming experiences, and even create or sponsor eSports teams. Real-world incentives for in-game performances and creating or sponsoring gaming tournaments round off the top five

initiatives Filipino gamers wish to see from brands.

Additionally, brands are advised to not only identify the game but also think about their natural role within the gaming world. A possible way to achieve success is through a multi-channel campaign that covers in-game and real-world activations. These may create greater engagement or offer higher chances of completing calls-to-action.

Mobile is your battlefield

It is common to associate the term ‘gaming’ with PCs and consoles but the Philippines’ gaming industry has been democratized as it is a predominantly mobile gaming country. Although Filipino gamers play on different platforms, mobile (95%) is still their device of choice compared to PC (28%) and console (12%) because it is portable, easy to use, and useful for unwinding before bed. Interestingly, PC and console gamers are noticeably lower in the Philippines compared to other markets.

This reinforces the point that gamers should no longer be considered a niche category. In fact, everyone is a gamer since they play on the go and during breaks. Another contributing factor to this trend is the rapid growth in Internet users in the Philippines due to the economic digitalization that followed COVID-19. The population is also bilingual, allowing them access to more gaming titles.

To get more bang for your buck, brands are advised to target consumers of all ages on mobile.

Not all Filipino gamers identify with the label ‘gamer’

Gaming is a popular activity in the Philippines. 61% of Filipino gamers identify with the label ‘gamer’, on par with the APAC average and sharing similar sentiments as counterparts in Singapore, Vietnam, Malaysia, and Indonesia.

Meanwhile, 28% do not consider themselves gamers and 10% are unsure. Across all generations, those do not associate with the term ‘gamer’ share two common themes for its definition: time spent playing and device played on.

The top reason was respondents only gaming on their smartphone (44%), like those in Malaysia, Indonesia, and Thailand. Some also said gaming is not their only hobby (35%) and that they do not play enough (33%).

These specific behavior traits indicate respondents potentially feel the label requires a certain amount of weight and dedication to be able to identify themselves as such.

It is important for brands to have tailored strategies for various audience segments. Brands can categorize them into ‘gamers’ and ‘casual players’ based on their behavior and how they identify themselves.

Also, the Philippine government has focused on showing how gaming can help society hone their life and professional skills, such as time management and multi-tasking. Companies can leverage this national momentum by working alongside governmental efforts to showcase the life skills gaming can offer and encourage the use of the term ‘gamer’.

Ensure mobile gaming integrations are low in time commitment

The act of gaming serves various purposes to Filipinos but most of them do so as a pastime and unwind from stress. When they play, they feel relaxed, happy, and excited. These feelings remain even after gaming and Filipinos even feel energized as they were able to escape reality.

The top five mobile gaming genres played at least once a week are multiplayer online battle arena (MOBA), word/trivia, card/board games, first-person shooter, and tile matching. These are all quick and easy-to-play genres as gamers can jump in and out with ease, and are mainly played by one user except for MOBA games, which are predominantly popular among gamers aged 18 to 35. The range of preferred genres is a strong indication that companies are not mainly dealing with hardcore gamers, reinforcing the point that everyone is a gamer.

That said, managing a busy schedule is the top factor that stops them from playing. Other factors are intrusive pop-up ads, the game not running smoothly on a device, and a toxic gameplay environment/stream.

With time and quality being the key barriers to the gaming experience, brands need to ensure their gaming integrations are low in time commitment, simple, and less frequent. Doing so could facilitate a positive experience that aligns with the gaming lore.

Keep Filipinos engaged with attention-grabbing creatives in games

Despite their busy schedules, Filipino gamers are still eager to complete their gameplay, including earning achievements and finishing side quests. 64% play as much as they can, 39% are determined to complete the entire game, and 32% rely on game recommendations from friends.

Therefore, it is important to keep them engaged in their limited time with new updates or credible recommendations, which will draw their attention to game titles. Brands can do so by creating game-specific creatives that will capture their attention without affecting the gaming experience.

Leverage the power of word of mouth and key opinion leaders

Word of mouth is key to unlocking gaming audiences. 89% of Filipino gamers source for gaming updates or news online mainly through gaming publishers on social media (51%), gaming influencers or content creators (44%), and blogs (33%). These key opinion leaders and their online discussions could offer strategic opportunities within a brand’s campaign.

When it comes to social media platforms, Facebook remains the top choice across all ages from 18 to 54. That said, brand communications should still be targeted and companies are advised to use the right platforms to reach their desired audiences.

The research surveyed 1,000 respondents in the Philippines – 49% male and 51% female. 40% were based in major cities, 21% from towns, and 19% from minor cities and the countryside, respectively. Most respondents were aged 35 to 44 years old (36%) and 18 to 24 years old (31%).

Overall, 12,204 respondents in Asia Pacific were surveyed across 13 markets. They are Australia, India, China, Indonesia, Philippines, Malaysia, Singapore, South Korea, Thailand, New Zealand, Taiwan, Hong Kong, and Vietnam. There is an equal gender split between male and female, and slightly more than two-thirds of respondents are aged 25 to 44 years old. The remaining 20% are aged 18 to 24 and 13% aged 45 to 54.